Federal withholding calculator 2020

There are two federal income tax withholding methods for use in 2021. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding.

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Median household income in 2020 was 67340.

. Based on your projected tax withholding for the year we can. The withholding tax amount depends on a number of factors so youll need the employees. The amount of income tax your employer withholds from your regular pay depends on two things.

First gather all the documentation you need to reference to calculate withholding tax. Youll need your most recent pay stubs and income tax return. States dont impose their own income tax for tax year 2022.

Before you start using the tax withholding calculator make sure that you have a completed Form W-4 from your employee. Use our W-4 calculator. Wage bracket method and percentage method.

The information you give your employer on Form W4. Since employers will also have to withhold based on. Federal Tax Withholding Calculator OPMgov Main Retirement Calculators Federal Tax Withholding Calculator Retirement Services Calculators The IRS hosts a withholding calculator.

Take these steps to fill out your new W-4. To calculate net pay subtract the total withholding for the pay period from the gross wages for the period Calculator can be used with Federal education loans. We suggest you lean on your latest tax return to make educated withholding changes.

Beranda 2020 calculator Federal Images. The tax withholding calculator can accommodate. Feeling good about your numbers.

Publication 15-T 2020 The below. Federal withholding calculator 2020 Kamis 01 September 2022 Edit. The amount you earn.

IRS tax forms. Enter a few paycheck-related amounts or adjusted amounts until your IRS tax withholding amount meets your expectations. Figure out which withholdings work best.

Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. For example if you received a tax refund eg.

1400 take that refund amount and divide it by the. The 2020 amount for one withholding allowance on an annual basis is 4300. TABLES FOR PERCENTAGE METHOD OF WITHHOLDING Source.

Then simply click Create W-4 and you are done. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime. You find that this amount of 2025 falls in the.

Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. 2022 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. How Your Paycheck Works.

Starting in 2020 the IRS will release the new Publication 15-T which includes the federal income tax withholding methods and table. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. Our free W4 calculator allows you to enter your tax.

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Payroll Taxes Methods Examples More

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Payroll Taxes For Your Small Business

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Inkwiry Federal Income Tax Brackets

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Paycheck Calculator Take Home Pay Calculator

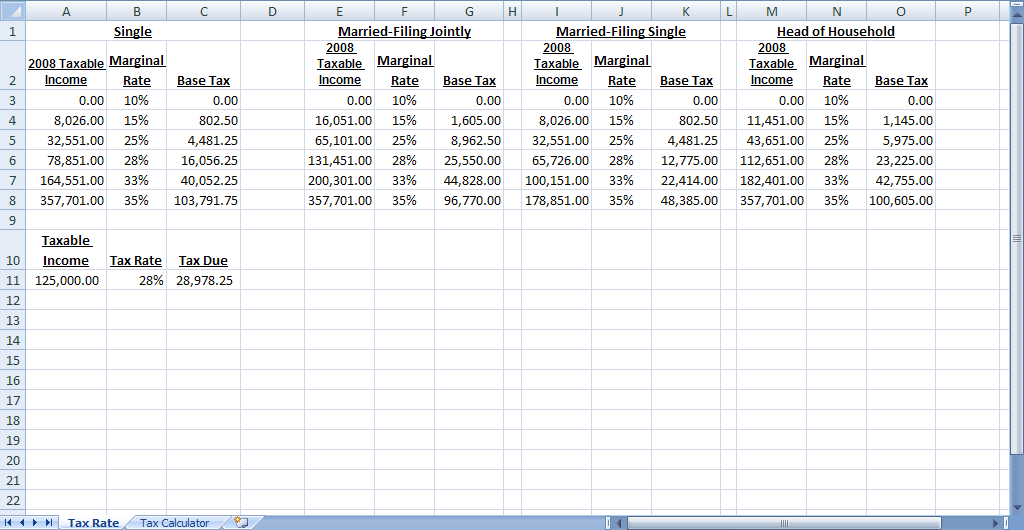

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Payroll Tax What It Is How To Calculate It Bench Accounting

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Income Tax

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Calculate Payroll Taxes For Your Small Business

Irs Improves Online Tax Withholding Calculator

How To Calculate Federal Income Tax